Household chores

I. Read the article below and find in it English equivalents for the following:

Task II, III and others are below the text!

UK kids to receive 2021 pay rise for household chores

06 January 2021

● Most kids receive pocket money for helping around the house (67 per cent) and being well behaved (50 per cent)

● Almost a third of parents in the UK admit to having ‘no idea’ or are ‘unsure’ on the ideal amount of pocket money

● Clare Francis, Director of Savings and Investments at Barclays, shares her top tips on teaching children about the value of money

6th January 2021: As we enter the new year, research from Barclays reveals that children in the UK will receive an average 8.2 per cent more for doing household chores in 2021 compared to 2020. This pay rise - which is approximately eight times the rate of inflation - follows a year spent largely at home, showing how much parents value having their children lend a helping hand.

Young people in Edinburgh are set to benefit from the pay rise most, with 84 per cent being given pocket money in exchange for household chores. It looks like the increase will benefit many of their peers across the country, too, as children in Glasgow (72 per cent), Norwich and Sheffield (73 per cent), Southampton (71 per cent), Liverpool and Manchester (70 per cent) earn their spending money in the same way.

The data shows most UK children get pocket money for doing chores (67 per cent), followed by receiving a financial incentive for being well behaved (50 per cent), doing well at school (48 per cent) and doing their homework (36 per cent). Just 8 per cent are given money for no reason.

Almost three quarters (74 per cent) of parents agree that their children appreciate money more when they earn it through household chores; and a fair amount they can earn, too! If a child were to give their room a weekly spruce, it would result in receiving £81.64 a year.

In addition, by simply sorting the recycling and taking the bins out each week they could pocket over £135 throughout 2021.

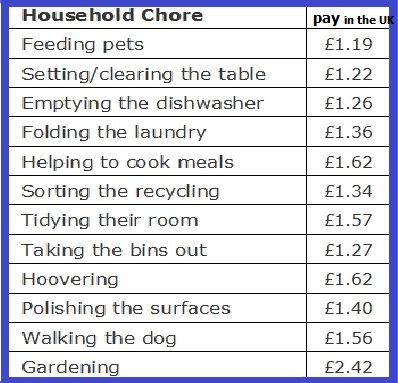

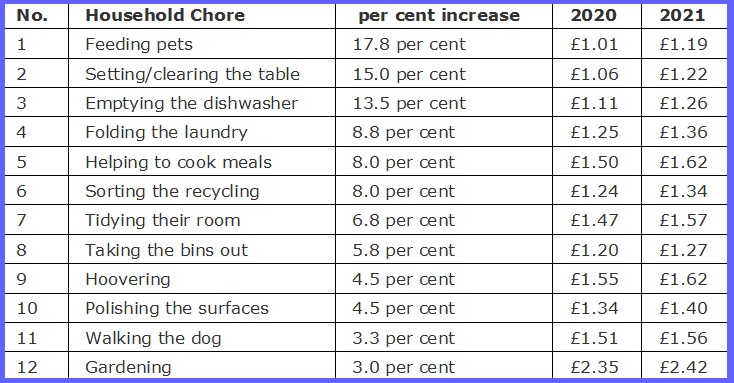

From polishing the surfaces to doing the hoovering, Barclays research unveils the household chores that have increased in value the most in 2021 for UK kids. Leading the way in the league table is feeding pets, which has gone up 17.8 per cent in payment. This is closely followed by setting/clearing the table with a 15 per cent increase, emptying the dishwasher with 13.5 per cent and folding the laundry at 8.8 per cent.

Despite the majority of parents (77 per cent) giving their kids a financial allowance - with a further 80 per cent agreeing pocket money teaches children the value of money - almost a third (31 per cent) admit to having ‘no idea’ or feeling ‘unsure’ what the ideal amount of pocket money is or should be.

The research also finds that almost a quarter of parents (23 per cent) choose not to give their children any pocket money at all. While 17 per cent believe children shouldn’t be paid for chores as helping around the house is just part of everyday family life, and 15 per cent said that they have other financial priorities.

Clare Francis, Director of Savings and Investments at Barclays, said: “When it comes to giving pocket money or rewarding kids for helping out around the house, there’s certainly not one size that fits all as parents have different views andcircumstances.

“There are various ways to teach your kids about finances from an early age, with pocket money being just one method that can help them develop a healthy relationship with money, build their independence, and increase their knowledge of how money works.”

Clare shares her top tips on how parents can teach their children the value of money and financial literacy from a young age:

1. Start pocket money young – I started giving my son £1 a week if he helped with jobs at home when he was about three. If he wasn’t helpful or his behaviour hadn’t been good, he didn’t get it. He saves his money up and when he’s got enough, he can buy a toy with it. If he doesn’t have enough for what he wants, he has to wait until he’s saved some more. This not only helps children learn about saving but it’s also a good way of getting them involved in doing the chores.

2. Talk to them about money – explain that you have to work to earn money so that you can afford to pay for the house you live in, the food you eat, the holidays you go on and all the fun things you do as a family. Trying to get them to understand that none of this is free is a good thing to do from an early age and you can obviously explain it in more detail as they get older. This will hopefully help stand them in good stead for when they have to manage their own finances.

3. Teach them the difference between wanting something and needing something – that helps them understand why you will buy them things like school shoes but will say no to things like Lego. It also helps them learn about the benefits of saving as that enables you to be able to afford some of the things you want as well as the stuff you need.

4. Open a savings account for them to pay birthday or Christmas money into – Taking them to the bank to pay the money in themselves can be a great thing to do and while it might be a chore for you to visit a bank branch, children often find it fun. Then talk to them about what they may want to save that money for. If they have a money box at home for pocket money which can be put towards smaller items, they might want e.g., toys, holiday spending money, the money in their bank could go towards something bigger e.g., bike.

To help guide mums and dads, below is a breakdown of the average value increase for each household chore, 2020 v 2021:

At present the following advantages and disadvantages of paying kids for household chores are seen by parents:

Advantages:

- Teaches Financial Responsibility – Children learn the value of money, budgeting, and saving when they earn their own income from chores.

- Encourages Work Ethic – It instills a sense of discipline, responsibility, and the understanding that effort leads to rewards, preparing them for future employment.

- Motivates Participation – Kids may be more willing to complete their chores consistently when there is a financial incentive.

- Introduces Real-World Concepts – The system mimics real-world employment, helping kids understand earning and spending before they enter the workforce.

- Fosters Independence – Earning their own money allows children to make independent financial decisions, reducing dependence on parents.

Disadvantages:

- Diminishes Intrinsic Motivation – Children may start viewing chores as optional and refuse to help unless they receive payment, rather than understanding that chores are a shared household responsibility.

- Creates a Transactional Mindset – Kids might develop the belief that all contributions should be compensated, rather than learning the value of cooperation and family support.

- Can Be Financially Unsustainable – Parents may struggle to maintain a consistent payment structure, especially in larger families.

- Leads to Negotiation Battles – Some children might demand higher pay for tasks or refuse unpaid chores, leading to conflicts over what should or should not be rewarded.

- Lacks Long-Term Effectiveness – Over time, kids might lose interest in completing chores once the novelty of earning money wears off, requiring parents to find other motivation strategies.

II. Do these vocabulary and morphology tasks

1. Insert prepositions where necessary:

- To teach the value of money

- To admithaving no idea the ideal amount of pocket money

- To resultreceiving a pay raise

- Despitekids’ unwillingness to help

- To pay moneyan account

Reload the page to do the test again until you get all answers green.

2. Find sentences with one or two words form each line in the chart below and paraphrase it so as to use a derivative [однокоренное] from the same line.

For example: It looks like the increase [of the pay] will benefit many of their peers across the country --> Many of their peers, apparently, will benefit from increasing the pay.

|

noun |

Adjective / negative adjective/Participle |

verb |

adverb |

|

‘increase |

increasing |

In’crease |

increasingly |

|

‘decrease |

Decreasing |

De’crease |

|

|

raise |

raising |

raise |

|

|

rise |

rising |

Rise-rose-risen |

|

|

value |

Valuable / invaluable/undervalued |

value |

invaluably |

|

evaluation |

Evaluating/ ed , evaluative |

evaluate |

Evaluatively / evaluatingly |

|

receipt |

Receivable |

receive |

|

|

Good behaviour |

Well-behaved behavioral |

To behave well To behave oneself |

Behaviorally |

|

reward |

|

reward |

|

|

Difference, differentiation |

Different/indifferent |

To differ , to differentiate |

(in)differently |

|

|

|

|

|

III. Choose the statement that best reflects the main idea of the article

- Some parents in Great Britain choose to pay their kids for doing household chores, because they can’t afford to hire cleaners.

- Increasingly more parents in the UK prefer to remunerate their kids’ helping them about the house, yet, admitting that such a policy is taxing on their family budget, as it often covers inflation.

- Parents are paying increasingly more for their kids’ help about the house, with gardening being the highest-paid job.

- While not all parents pay their children financial allowances for helping about the house, a big amount of them still do, being ready to raise such rewards above inflation and explaining such a policy by a number of benefits for kids’ later life.

IV. Think of answers to the questions:

1. Should children be paid for household chores? Why?

2. How did /do your parents get you to help them about the house?

3. What would you tell your kids about money?

V. [lETS] Write an essay on the topic.

Do the advantages of paying children for household chores outweigh the disadvantages? Give grounds to your ideas. Write 250-300 words.

Study the template, which will let you meet the task response criterion

VI. Write an analysis of the table from the text.

1. [IELTS] You should spend about 20 minutes on this task

The chart below shows how the pay to the UK children for helping about the house changed from 2020 to 2021.

Summarize the information by selecting and reporting the main features,and make comparisons where relevant.

Write at least 150 words.

2. [ЕГЭ] Imagine that you are doing a project on how pay for household chores to British children has risen. You have collected some data on the subject – the results of a survey (see the table above).Comment on the data in the table and give your personal opinion on the subject of the project.

Write 200–250 words.

Use the following plan:

– make an opening statement on the subject of the project work;

– select and report 2–3 main features;

– make 1–2 comparisons where relevant;

– outline a problem that can arise from paying kids for for doing house work and suggest a way of solving it;

– draw a conclusion giving your personal opinion on paying kids for doing household chores.

VII. [TOEFL] Retell the article in about 15 sentences using the active words from the test above.

Some useful introductory phrases:

- The given article is about _____.

- The author raises the question of_______ .

- The author feels that ______.

- The ...... presents [one/two/three] theories about _____.

- The writer disputes/supports / approves of the claims made .... / wide-spread beliefs / perception of...as...

- His/her position is that _____.

- According to the lecture / podcast/video/article, _____.

- The speaker / host(ess)/author mentions that ____.

- The lecturer challenges this argument.

- He/she claims that ____.

- Additionally, he/she points out that ______.

- Secondly, the speaker provides us with anecdotal evidence /statistics of ______.

- In the podcast/lecture/audio, it is said/claimed/alleged that _____.

- It is widely believed that ______

- The lecturer, however, asserts that ______.

- He/she goes on to say that ______.

- Finally, the speaker/host(ess) posits that _____.

- The ... contends that ____.

- In contrast, the lecturer’s /writer's stance is _____.

- He/she notes that _____.

- All in all, the bottom line is that...

- To conclude, the text addresses the issue of... and offers a number of feasible solutions to it.

VIII. Make up the dialogue:

Imagine that you are the mother of a teenager who is constantly asking for money and demanding that you buy her various fashionable clothes, makeup, accessories as well as spending an awful lot on snacks. Try to teach her about the value of money. She doesn’t understand you at first. Finally she agrees to replace the maid so that you will pay her for her chores.

Use:

- Mum, could you V1?

- It is ages since I + Past Simple = Сто лет прошло как я (покупала себе что-то значимое, классное, крутое,…)

- It is high time you + Past Simple=Пора бы тебе….

- You are constantly V-ing

- To ask for=просить

- To run out =заканчиваться

- I can’t help it =Ничего не могу с этим поделать

- You have +already + V3 this month

- No, it is the first time + Present Perfect.

- Come on! Stop kidding me!

- Look, you are a big girl

- To work like a horse

- To pull one’s weight

- Not to stir a finger = not to give an inch =и пальцем не пошевелить

- What do you want me to V1?

- I mean you to V1

- By the way, what if we + Present Simple =Кстати, а сто если мы (уволим уборщицу)

- To replace smb

- To pay smb for ….

- To be in two minds = колебаться

- to have to cut down on one’s expenses

- budget is tight=бюджет ограничен

- Appetite [ai] is boundless

- to bring home bacon =быть добытчиком